My Investing Notebook

:: Learning from the pros; making decisions on my own. ::

My Investing Notebook

:: Learning from the pros; making decisions on my own. ::

My Investing Notebook

:: Learning from the pros; making decisions on my own. ::

My Investing Notebook

:: Learning from the pros; making decisions on my own. ::

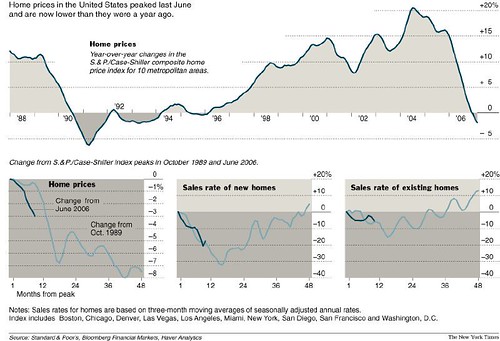

Not according to this chart.

This article, Is It Time to Buy a House Yet?, was part of today’s Must Read newsletter from Seeking Alpha (a good resource for investors). It caught my attention. I like to read stories about housing. But what really caught my attention was the chart you just saw.

Do we really have a few more years of downturn? I think so. I don’t think we’re out of the woods yet. But as with everything, and especially money issues, you never know.

Mr. Smith does have some valid and interesting points. Here a few.

Simply put: if the bubble took seven years to reach its blow-off top, then its decline will typically take a similar length of time as prices fully retrace to pre-bubble levels.

As for supply: it is common knowledge that hundreds of thousands of homes are currently in the limbo of “shadow inventory”–homes the lenders won’t foreclose on for fear they can’t be sold, homes held off the market by owners who are deeply underwater on their mortgages, etc. As soon as demand appears, then supply rockets up as those anxious to sell move properties from the “shadow inventory” into the market.

Interesting article to read.

I’m kicking myself a bit. How come I did not know about the subprime lenders before?! I had been talking about a housing downturn for some time now. However, till last couple of weeks, when the meltdown actually began, I did not know that there were lenders that were doing subprime lending only. Had I known, I would have shorted New Centrury ( (NEW), almost bankrupt, from $30), Accredited ( (LEND)), Novastar ( (NFI) and Fremont ( (FMT)).

Either way, shorting is very risky. I tried shorting Countrywide ( (CFC)), but I only did it for a day. I chickened out after I read a favorable report on the stock. Countrywide, even though it has the biggest exposure to subprime, is a sound company. Plus, it’s already down a lot.

Housing downturn has only begun. I am still hoping things will settle down in 2008, but it might be even longer than that.

Is is a good time to buy now?

I don’t think so. It’s going to take a lot longer for this market to finally settle down. It’s going to be up and down for some time.

The housing market will settle down and might start going up sometime in 2008 — I’m not the only one that thinks like that, a lot of economists have the same view. Why so long? It was an up market for a long time, 1998 – 2005. It’s going to take a long time come down.

“It may not be until 2008 until the market bottoms out,” predicted James Hughes, dean of the Bloustein School of Planning and Public Policy at Rutgers University.The problem, Hughes said, is the “extraordinary gains” in the market played out over seven years, from 1998 to 2005. When the highs last a long time, “it takes time to adjust,” he said.

I see a lot of reductions in the current market, but they’re not big enough for me. The way it looks now, I can probably buy something in the 350-400K range (in NJ). I’m looking for something around 300K. Not there yet. But I think it will get there by 2008. If not, oh well, I’ll have to pay more, or continue renting.

ReferenceNew-home sales still declining, NJ.com

This is where the housing market currently is:- median home sale-price appreciation: sharply down- new home inventory: sharply up- single-family home sales: slowly going down- mortgage apps: down

We should see interesting years ahead. For more detaisl and to see big charts, go to the article referenced below.

ReferenceRecent Housing Data: Charts & Analysis, The Big Picture blog

If you’re looking to buy a house (like me; but think house prices are crazy), this article is great to read. Wnen I was reading it, I felt music flowing in my ears. I kept telling myself: this is great stuff. If you already own one or you’re looking to sell, this might be too hard to swallow, though. Great article.

ReferenceViewpoint: Housing bubble going bust nationally, found it on Economy.com

Welcome to the dead zone, Fortune Magazine

No comments needed. Excellent summary of the current housing market.

If the U.S. housing market is not a bubble bursting, it is at least a boom deflating, as new data made clear today.New home sales sank 10.5% last month, the Commerce Department said, the biggest decline since April 1997 and far bigger than economists expected. The seasonally adjusted annualized rate of home sales was the slowest in nearly two years. Sales have fallen in four of the past six months. Meanwhile, the number of unsold homes on the market rose more than 4%, representing a 6.3-month supply, the highest in more than a decade. Unsurprisingly for anyone with a vague knowledge of basic economic principles, rising supply and falling demand means new-home prices are falling. The median price for a new home fell for the fourth straight month to $230,400, nearly 3% lower than a year ago. It was the first time prices have fallen on a year-over-year basis since December 2003.

New-home sales make up less than 14% of the total housing market; pre-owned homes make up the rest, and they rose solidly last month. But new-home sales are typically a leading indicator of housing trends, while used-home sales are lagging. And last month’s strength in used-home sales was likely the aftereffect of January’s temporarily warm weather and lower mortgage rates.

Some observers worry that rising mortgage rates will hurt the housing market; they certainly won’t help. The Federal Reserve is almost certain to raise short-term borrowing costs next week and could raise at least once more by May. That has no direct impact on 30-year mortgage rates, but could possibly make adjustable-rate and more exotic flavors of mortgage more expensive.

But one reason housing is slowing down already, even with borrowing rates still relatively low, is that many houses have simply become unaffordable to many buyers. A strong economy and job market will keep some buyers in the game, but a slowdown in housing is likely to hurt the economy. The only question at this point, it seems, is whether the housing slowdown will be gentle or screeching. Most economists are in the gentle camp, but a few are not. One of those self-described “uber-bears” on housing, Ian Shepherdson of High Frequency Economics, called today’s report “awful, but not yet a convincing collapse.” Comforting.

By MARK GONGLOFF, WSJ.com

Not a good sign. But I knew it was coming. And it’s only going to get worse in the years ahead.

Do you know how to get information about the foreclosures in your area? Is there a website for that purpuse (I’m sure there is). I’d like to get access to that. I think it might be a good way to snap a bargain (not now, but in a year or two).

In January, 103,540 homes were in foreclosure, up 27% from 81,290 in December and 45% above last year. January’s foreclosure total was the highest level since RealtyTrac began releasing monthly reports in May 2005.

January’s 27% increase in foreclosures is consistent with the increasing foreclosure trend seen throughout 2005. In total, nearly 847,000 properties entered foreclosure in 2005, representing 0.7% of total households. This is still below the historical average of approximately 1%, according to RealtyTrac.

In our opinion, the recent sharp increases seen in foreclosures are indicative of the heightened leverage taken on by home buyers through the past several years of robust price appreciation and record-low interest rates. In addition, we expect the proliferation of adjustable rate mortgage (ARM) and interest-only mortgage products tied to the short end of the curve to provide an additional headwind as short-term interest rates continue to increase. For 2006 year-to-date, on average, the one-year ARM is 132 basis points higher than last year.

ReferenceForeclosure Surge Indicates Home Stretch, Barron’s Online, INVESTORS’ SOAPBOX PM (Need subscription to access)

I’m a bit worried about the housing market. You probably know that I’m not buying a house at these prices, especially in the NJ area. But I’m worried that the buyers are over stretching themselves, and when the interest rates rise (a little more), many of them will not be able to pay for their mortgage. As a result, the pool of buyers will shorten. As a result, the whole economy might suffer. That’s what I’m worried the most. But like I said, this frenzy cannot continue, and will not continue, forever. Every bubble inflates to the point when it bursts. Hopefully, it will only be by a slow deflation…

There is an interesting article on Economist.com (one of my favorite magazines; recently subscribed to it), about the housing market in US, and in other parts of the world. I have some interesting excerpts from the The Economist article, Miraculous recovery or last gasp?.

If the housing market does turn sour, it would be bad news for the American economy, as it has been for the economy in Britain, where the recent slowdown has been partially attributed to a weak housing market. In both countries, consumers have become dangerously dependent on strong house prices to keep them feeling wealthy enough to spend. Housing markets may be the canaries that signal the fate of the broader economy. And, as any miner will tell you, canaries don稚 live all that long.

ReferenceMiraculous recovery or last gasp? — The Economist

Sorry. No data so far.