My Investing Notebook

:: Learning from the pros; making decisions on my own. ::

My Investing Notebook

:: Learning from the pros; making decisions on my own. ::

My Investing Notebook

:: Learning from the pros; making decisions on my own. ::

My Investing Notebook

:: Learning from the pros; making decisions on my own. ::

It’s not easy to be in the stock market in the past few days and weeks. I had a feeling that the stock market recovered a bit too high too soon. I should have capitalized on that. How? By betting that it will correct itself. How do you do that? By “shorting,” which is a way to make money when a stock goes down: you’re basically betting that a stock will go down, and when it does, you make money. I just discovered that there are now ETFs designed specifically for that purpose. That’s a very good investor’s resource, in my opinion.

Here are a few ETFs that do the “shorting” for you:ProShares Ultrashort ( (QQQ)) – rewards a fall in the Nasdaq;Proshares Ultrashort S&P 500 ( (SDS))- rewards a fall in the S&P benchmarkProshares Ultrashort Dow 30 ( (DXD)) – rewards the fall in the bluechip industrials.

Rydex recently rolled out eight new ETFs, half of which offer double-inverse plays on the energy, financial, health care and technology sectors. The Rydex Inverse 2x Select Sector Financial ( (RFN)) – up more than 8 percent in light Thursday trading.

Keep in mind that “shorting” can cause unlimited losses: if stocks go up, you lose. But these ETFs do limit the risk somewhat and that is a very good think.

Reference

Shorting Stocks Could Be Way to Play This Market, cnbc.com article

There was an interesting observation in the S&P Outlook recently. Since 1945, in the period from November-April, the S&P 500 returned 7.19%; in the May-October period, just 1.6%. What do do? Sell in May, and Buy back in November!

I think this is true this year. I feel like we’re due for a correction. It might be a good time now, especially after the recent records.

They recommend doing the following.

For May-October overweigh- consumer staples- health care

For November – April overweigh- financials- industrials- materials- consumer discretionary- information technology

Now that’s an interesting observation…

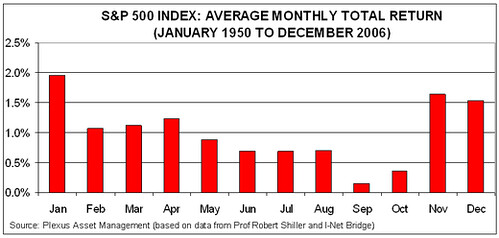

Here’s a chart that breaks the returns by month, averaged since 1950.

ETFs are great. They allow you to buy the whole index of stocks with one purchase. I have always like them. But these days, there are new ETFs coming daily. Where should you invest? John Bogle, featured in Barron’s has some good advice, I think.

Q: Let’s say an individual has a million dollars to spend in constructing a stock and bond portfolio with ETFs. What kind of ETFs would you recommend their using?A: First off, we expect that investors should talk with their financial advisers about their particular needs. The basic strategy that we see people using is buying the broad benchmark, so perhaps the Russell 3000 Index Fund (ticker: (IWV)) and the MSCI EAFE Index Fund ( (EFA)), which gives you exposure to all the developed non-U.S. markets such as Western Europe and Japan. And depending on an individual risk tolerance and preferences and liquidity needs, we have bond funds. If you want to maintain greater liquidity, we see a lot of people who do that in our short-term Treasury fund [Lehman Short Treasury Bond Fund] ( (SHV)). But for longer-term investments we see people investing more frequently in things like the iBoxx Investment Grade Corporate Bond Fund ( (LQD)).

ReferenceWhat’s the Skinny on Skinny ETFs? – Barron’s Online

Excellent and thorough article on a basic, fundamental truth. It’s something that I deeply believe in: investing is for the long term. If you think you can time the market, you might get burned out, especially now. But if you can invest for the long term, for at least five years, you’ll do well. Simple as that.

ReferenceReacting to Market Declines: The Case for Staying Invested, Fidelity Investor’s Weekly Newsletter (very good newsletter, btw)

Do you know what’s going on in the housing market? Do you want to know the latest interest rates on a 30-year mortgage? Are you interested in the housing market in general? Is so, Real Estate Weekly newsletter is for you.

This newsletter is filled with useful, relevant information. It comes in to my e-mail box every Friday. I always look forward to reading — mostly scanning — it for couple minutes, but occasionally reading an article or two that it refers to. This is good stuff. I recommend it.

You can read the latest newsletter, March 10, 2006 edition here.

ReferenceReal Estate Weekly, MarketWatch eNewsletter- To receive the newsletter, you need to create a free MarketWatch account, sign in, and sign up for the newsletter from your account details (I was not able to find a link to sign up directly.)

The article, A Rich Harvest of Losses, in the latest issue of BusinessWeek (my favorite mag) — Oct 31st, 2005 — contains a lot of good advice on how to maximize your taxes (or how to pay the least amount of it). I’ll take the most important excerpts.

You can gain money from this advice if you have stocks that lost in value since you bought them.

Find losses and squeeze some tax benefits from them. Short term losses are more valuable than long-term losses. Why? They can be used to offset short-term gains on which the tax rate can run as high as 35%, depending on your income.

But what if there are stocks you don’t want to sell?You can sell a company and buy it back 31 days later. But make sure you wait 31 days or you will be hit with a wash-sale rule, erasing your benefits.

There is another way, also explained in the article. If you still don’t want to sell your stocks, you double up on them.

One way to douple up — purchase a company shares equivalent to the number you want to unload — and sell the older, higher priced shares after 31 days. You take a loss on the older shares, but establish a new position at a lower price.

Another way, swap your losers with similar companies, or buy an ETF that has a lot of stock in the company you own.

This is some good information from BusinessWeek. I could have used this info last year, when I had some gains.

ReferenceA Rich Harves of Losses: BusinessWeek, October 21st, 2005

|

Sure, it is always nice to buy something and have it surge immediately afterwards. Delightfully, this does happen. But aside from being lucky, investment is all about finding value that emerges over time. Markets tend to be overly short-term oriented; so long-term investors can always find something worth buying whenever the market responds to temporary events.

–Dr. Charles Lieberman

in Barron’s Investor’s Soapbox |

Can’t agree with it more. If you’re a short-term investor or you just want to make a guick buck, you might get lucky and come ahead the smartest guy in the world. However, true investors put their money to work for long periods of time (at least 5 years). They invest in something they like and they get good returns. They always win, as opposed to short-term investors — speculators — who win only some of the time.

I just signed up for the I Will Teach You To Be Rich blog yesterday and I’m already finding great stuff: Warren Buffet’s letters. When the greatest investor of all speaks, open your ears. He sees things ahead of everybody else. Read them every year, that’ s my tip.

I recently gave a speech titled “Investing 101.” It was for my local Toastmasters club. In the speech, I covered some things that might be of interest to individual investors. I’d like to share some of them, below.

Stock Market 101

What is a stock market? It’s where all public companies are listed and are available to be traded. Public? After a company has been successful and the owners decide to make some big money, they sell the company to the public — investors like you. Once the company is public, the original owners no longer own the company. How do you buy shares of the company? You can do it in a brokerage account, or you can buy the shares directly from the company (some companies allow it).

How does a company go up and down? A company goes up when there are more buyers than sellers. That’s the basic idea. For example, Coca Cola makes the news that they’re going to introduce a Super Cola. People that don’t have any shares in the company want to buy some. However, the people that hold the shares hear the news as well. They don’t want to sell the shares. They’d sell it at a premium. So the new people buy it at a premium and the price of the stock goes up.

Are there any risks in investing? Certainly. There are two types of risks: company risk, and market risk. If a company delivers some bad news, it will go down. Sometimes, sharply. The other risk is when the whole economy is not doing well. In that case, most companies go down. Nonetheless, the stock market has been the single best place to put your money over time.

How I Started It

It all started as a Yahoo game (I believe you still can do it) in college. Yahoo gives you 100K and you invest it anyway you want it. Some of my friends were doing it, so why not try it? So I tried it, and I was doing good. At that time, late 90′s, everything was going up. I remember that once I put money into Oracle, and within months, it quadrupled.

So I decided to open a brokerage account. It was all good for a couple of months. However, at that time, the bubble started to burst. I lost a lot of money. As I looked back, I said to myself that I didn’t know enough about the whole investing process and about which companies to invest in. So I subscribed to several magazines. I started reading. I gaines some confidence. My stocks started to go up again and I recovered most of the money I lost.

I’m still an investor now. I invest regularly. But for the first time, I feel that I’m in control.

My Tips & Strategies

Do I have any secrets? No, no secrets, just tips. First of all, invest as soon as you can. You don’t have to have a lot. Start small: couple hundred is enough.

Invest regularly and put money into the same companies over and over. That way, when the company goes down, you’ll buy more of it for the same money, and you’ll even out when it eventually recovers.

Invest for the long term. If you’re not going to invest for at least 5 years, don’t do it. Just don’t do it. It’s not worth it.

Invest in ETFs and Mutual Funds. ETF, Exchange Traded Fund, is basically a group of stocks traded as one. One good one is the S&P 500 — SPY is the symbol (I have several others). ETFs minimize risks. Mutual Funds? When you invest in Mutual Funds, you’re basically paying somebody to trade for you. One great company — low fees, good choices — is Vanguard.

Brokerage accounts. I use two brokers: FirstTrade.com and Interactive Brokers. I buy Mutual Funds at First Trade (free) and I pay a $1 per trade at Interactive. However, an excellent choice for starters (I’m looking into this too — it would be my 3rd broker), is BuyAndHold.com. BuyAndHold lets you invest as little as $20 per month into a company and re-invest regularly. It’s called dollar-cost averaging and I recommend doing that.

Diversify. Don’t just buy one company and hold on to it. It’s too risky. Spread your risk. Diversify. It’s the key word in investing. Buy several companies, buy ETFs, buy Mutual Funds. Minimize the risk. That’s the way I do it.

If you invest regularly and for the long term, you should do well.

Sorry. No data so far.