My Investing Notebook

:: Learning from the pros; making decisions on my own. ::

My Investing Notebook

:: Learning from the pros; making decisions on my own. ::

My Investing Notebook

:: Learning from the pros; making decisions on my own. ::

My Investing Notebook

:: Learning from the pros; making decisions on my own. ::

While at the Barnes & Noble today, I got drawned in by a title in US World & Reports: The 100 Best Mutual Funds for the Long Run. Sure enough, I found a few funds that I think are top quality.

The Yacktman Fund (YACKX)

Comparing it to Fidelity Contrafund, which is considered one the top funds, I can see why Yacktman is on top: 3 year return of 8.9% is much better than -0.2% for the Fidelity fund.

Sextant International (SSIFX)

Very good returns. Better than Marsico Global, also a top rated fund.

Fidelity Canada (FICDX)

Very good returns.

Coming from the Feb 2010 SmartMoney magazine.

iShares Barclays TIPS Bond (TIP)

1-5 Year US TIPS Index (STPZ)

IQ CPI Inflation Hedged (CPI)

Here are some funds that offer diversified exposure to the emerging markets in Europe, Asia, Africa/Middle East, and Latin America. These are taken from the latest BusinessWeek, Dec 28th edition.

Sorted by 2009 Total Return

Easter European Equity (VEEEX)

98% Europe, 1% Asia, 1% Latin America

Fidelity Emerging Europe, Middle East, Africa (FEMEX)

70% Africa/Middle East, 30% Europe

SPDR S&P Emerging Middle East & Africa (GAF)

100% Africa/Middle East

Claymore/BNY Mellon Frontier Markets (FRN)

51% Latin America, 26% Africa/Middle East, 17% Europe, 6% Asia

Templeton Frontier Markets (TFMAX)

50% Africa/Middle East, 25% Asia, 22% Europe, 3% Latin America

Invest 10% in all of these 10 ETFs and you got yourself something close to what an Ivy League portfolio looks like. For more information, check theivy.portfolio.com

iPath S&P GSCI Total Return Index (GSP)

iShares Barclays TIPS Bond (TIP)

PowerShares DB Commodity Index Tracking (DBC)

SPDR Dow Jones International Real Estate (RWX)

Vanguard Emerging Markets Stock (VWO)

Vanguard FTSE All-World Ex-US (VEU)

Vanguard REIT Index (VNQ)

Vanguard Small Cap (VB)

Vanguard Total Bond Market (BND)

Vanguard Total Stock Market (VTI)

Reference

Kiplinger’s Magazine – 11/2009 Issue

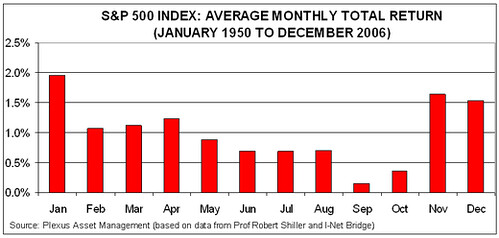

There was an interesting observation in the S&P Outlook recently. Since 1945, in the period from November-April, the S&P 500 returned 7.19%; in the May-October period, just 1.6%. What do do? Sell in May, and Buy back in November!

I think this is true this year. I feel like we’re due for a correction. It might be a good time now, especially after the recent records.

They recommend doing the following.

For May-October overweigh- consumer staples- health care

For November – April overweigh- financials- industrials- materials- consumer discretionary- information technology

Now that’s an interesting observation…

Here’s a chart that breaks the returns by month, averaged since 1950.

I like Vanguard as a company. I have been with them for a couple of years now. I like what they offer: both, in terms of fund selection, and in terms of the services they offer.

Why would I want to invest in Vanguard funds? First, they give you a good selection. And second, you can put your investments on auto pilot: you can actually do dollar-cost averaging at no cost!

So far, I have invested in 2 funds at Vanguard (NJ Tax-Free Fund; and S&P Index Fund). Every month, $50 gets automatically invested into each of them from my bank account. I really like that.

The downside? There is usually a $3K minimum investment for each of the funds. (It would be great if it was $1K.)

I am planning to shift some of my money from my brokerage account into Vanguard. Like I said, having an auto pilot is a very good benefit for me.

Here are some of the funds at Vanguard that I find interesting (besides the 2 I own). You can take a look at all of them at https://flagship.vanguard.com/VGApp/hnw/FundsByTypeSec

Taxable Short-Term BondVanguard Short-Term Investment-Grade Fund Investor Shares (VFSTX)Average annual return: 4.96% (1 year) 3.68% (5 year) 5.13% (10 year)

BalancedVanguard STAR Fund (VGSTX)Average annual return: 9.79% (1 year) 8.63% (5 year) 8.94% (10 year)

Vanguard Wellesley Income Fund Investor Shares (VWINX)60% bonds; 40% stocksAverage annual return: 10.69% (1 year) 7.26% (5 year) 8.51% (10 year)

Vanguard Wellington Fund Investor Shares (VWELX)32% bonds; 65% stocksAverage annual return: 12.85% (1 year) 9.04% (5 year) 9.52% (10 year)Negative: 10K initial investment required

Domestic Stock – GeneralVanguard Dividend Growth Fund (VDIGX)Average annual return: 17.84% (1 year) 7.56% (5 year) 6.84% (10 year)

Vanguard Windsor II Fund Investor Shares (VWNFX)Average annual return: 17.19% (1 year) 10.90% (5 year) 9.89% (10 year)

International/Global StockVanguard International Value Fund (VTRIX)Average annual return: 18.94% (1 year) 18.05% (5 year) 9.67% (10 year)

Vanguard Total International Stock Index Fund (VGTSX)Average annual return: 19.64% (1 year) 17.41% (5 year) 8.15% (10 year)

Vanguard Global Equity Fund (VHGEX)Average annual return: 19.12% (1 year) 17.94% (5 year) 12.50% (10 year)

Here are my current holdings in the beginning of 2007. My strategy now is still go with a defensive lineup and also diversify more internationally. I also decreased my position in energy. I’m going to stick to my strategy and even increase my exposure to ETFs and opt for less risk than investing in individual stocks.

AIG (AIG) » Insurance: $68: A giant that’s beaten up a bit. Should recover. Quality stock..

General Electric (GE) » Conglomerate: $36: Quality company with good management. Diversified. Looks cheap.

Kraft (KFT) » Food: My recent addition. Company makes good products, moves into more healthy oriented products. Good international player.

Matsushita (MC) » Consumer Electronics: Panasonic makes the best plasmas and cameras. Good growth potential.

Medtronic (MDT) » Health Products: It’s beaten down now but a quality company with very good growth potential.

Pfizer (PFE) » Drugs: One of the biggest and beaten down. Good pipeline.

Time Warner (TWX) » Media & Internet Services: I believe content is the king and will eventually provide the most value. I’m losing my patience with AOL and I might unload in the near future.

Verizon (VZ) » Telecom: I’m still optimistic about the fiber rollout. The best wireless provider.

Yahoo (YHOO) » Internet Services: I think Yahoo is cheap compared to Google. Good search technology. Very good growth potential. Cheap.

Exxon Mobil (XOM) » Energy: The biggest energy player. Safe bet.

My current ETFs

Emerging Market Index (EEM) » International: It slowed down recently but still a good diverifier.

Europe Index Fund (EFA) » Europe: Recommended by S&P, good diversified holding.

Pacific, Excluding Japan (EPP) » Pacific: Recommended by S&P. A lot of potential growth.

Japan Index (EWJ) » Japan: Japan is recovering. Recommended by S&P.

US Telecom Sector (IYZ) » Telecom Sector: Telecom is a good defensive sector.

S&P Midcap 400 (MDY) » Midcaps: Recommended by S&P.

Spider Divident ETF (SDY) » Divident Focused: I am a big fan of companies that keep increasing their dividents. This ETF is focusing on that.

Vanguard Divident ETF (VIG) » Divident Focused: Similar story to SDY, divident focused with a little different lineup.

S&P Index (SPY) » S&P: Over the years, the S&P index beats most of the funds.

Vanguard Energy ETF (VDE) » Energy: Is energy ever going to go down? Probably, but not anytime soon it looks like.

Vanguard Health Care (VHT) » Health Care: Baby boomers are starting to retire. Health care has very good growth potential.

Consumer Staples Sector (XLP) » Consumer Staples: Even in a slow economy, people still need to buy everyday products. Good defensive player.

Lehman Aggregate Bond Fund (AGG) » Bond: I hold it because it’s recommended by S&P. I do think that diversification in bonds is imporant.

Lehman 1-3yr Tresuries (SHY) » Bonds: Recommended by S&P.

Whoa, that took me some time. I have 3-5% in most of these, with around 7% for the S&P Index.

I am just looking over the 2006 Semi-Annual iShares MSCI Series report I received today. I’m thinking, US economy will slow in the next year or two. Looking at the markets outside of US, I might want to invest in other assets.

For instance, iShares Australia Index (EWA). 1 year return: 15.83%; 5 year return: 148%.

Brazil Index (EWZ): 1 year: 70%; 5 years: 187%

Canada Index (EWC): 1 year: 33%; 5 years: 103%

Mexico Index (EWW): 1 year: 45%; 5 years: 194%

Those are some impressive returns. I like Canada and Australia indexes: stable countries with very good results. I should have invested in Brazil when it went down a year or two ago; same with Mexico.

Sorry. No data so far.